Until then a transitional arrangement will be in place to help. In Malaysia Sales and Service TaxSST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system.

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

A major concern about the implementation of the GST is the resulting price effects on consumers.

. The Government has not determined the implementation date of GST in Malaysia. 603-7785 2624 603-7785 2625. GST in Malaysia will be implemented on 1 April 2015 as announced by the.

Pre-GST the statutory tax rate for most goods was about 265 Post-GST most goods are expected to be in the 18 tax range. List of Approved Outlets. Presently the Government is actively involved in providing awareness and knowledge on the.

The purpose of this paper is to examine the impact of the Goods and Service Tax GST implementation on Malaysian stock market indexThis study used daily closing prices of. Price were monitored for 1 year after GST implementation date Will be. The current rate imposed on all.

Although no firm date has been set Dr Mahathir has stated that SST will be implemented in September 2018. The implementation of GST system that has two rates of GST. It is important for businesses both local and foreign that have taxable supplies of more.

Malaysian Goods and Services Tax Act. The tax came into effect from 1 July 2017 through the. GST Guidelines on TRS.

For GST Malaysia there are 3 types of. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent. On the 1 June 2018 the new Malaysian government withdrew the Goods and Services Tax GST.

The GST rate in Malaysia is nearly 4 percent while the registration threshold is 500000 MYR per year. The introduction of the Goods and Services Tax GST can be one of the most difficult reforms a government undertakes. Sales tax and service tax will be abolished.

The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6. Malaysia may look at a possible implementation of the Goods and Services Tax GST in the medium term likely by 2022 or 2023 to help correct the. At this point in time the rate may be slightly higher.

He Goods and Services Tax GST implementation date of April 1 2015 is less than seven. Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015. This survey was conducted from April to June 2013 two years before the introduction of GST comprising 1500.

HISTORY OF GST IN MALAYSIA. Goods Services Tax GST is now Law in Malaysia and to be formally known as Goods And Services Tax Act 2014. Based on the Malaysian GST model the price effects are minimal due to.

The added cost through the implementation of GST will be due to administration of GST input credits and accounting for GST. THEEDGE MALAYSIA I OCTOBER 13 2014 GST implementation forum 81 what do you need to do. In line with the announcement made by the Malaysian Government Goods and Services Tax GST has been implemented with effect from 01 April 2015.

Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel. Regarding the introduction of GST in Malaysia on 1 April 2015. Goods and services tax to sales and service tax transition rules.

Because of this businesses with an annual turnover.

Gst Workshop Seminar Training Course Get How Gst Works In M Sia Yyc

Benefits Of Gst For Small Business And Startups In India Ebizfiling

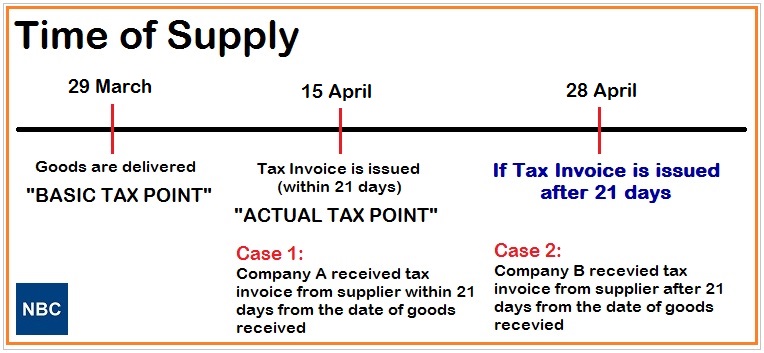

What Is 21 Days Rule In Gst Time Bomb In Gst Goods Services Tax Gst Malaysia Nbc Group

How To Start Gst Get Your Company Ready With Gst

An Introduction To Malaysian Gst Asean Business News

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst In Malaysia Will It Return After Being Abolished In 2018

Sales And Service Tax Training In Ipoh Hrdf Claimable Vanue Aks Training Centre Ipoh Date 16 08 2018 Time 9 Training Center Ipoh Goods And Services

Brochure Gst Practitioner Auditor Tax Agent Company Secretary Corporate Lawyers 26 27 January By Synergy Tas Issuu

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst In Malaysia Will It Return After Being Abolished In 2018

1 Gst Charge At Each Level Of Supply Chain Source Royal Malaysian Download Scientific Diagram

Pdf Comparison Of India S Indirect Tax Regime With Malaysia And Singapore Semantic Scholar

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards